Introduction

Supply management is a hotly debated and long-standing agricultural institution in Canada. As I will explain further on, supply management was introduced over 50 years ago to offer stable prices to an elite group, by imposing a quota and import tariffs to restrict supply, while also increasing prices and their profits. In essence, this policy takes from the many and gives to the few, increasing dairy and egg product prices by a small margin and distributing the proceeds to a small subset of farmers. This system not only affects domestic production but also imports are limited through a quota system and import tariffs, respectively. Since these foods are common staple foods for Canadians, this policy imposes a nearly immeasurable tax on most households.

As I will explain further on, supply management was introduced over 50 years ago to offer stable prices to an elite group, by imposing a quota and import tariffs to restrict supply, while also increasing prices and their profits. In essence, this policy takes from the many and gives to the few, increasing dairy and egg product prices by a small margin and distributing the proceeds to a small subset of farmers. This system not only affects domestic production but also imports are limited through a quota system and import tariffs, respectively. Since these foods are common staple foods for Canadians, this policy imposes a nearly immeasurable tax on most households.

In 2017, there were 15,388 quota holders in Canada, and 11,035 farmers were reported as having shipped milk, which requires being a dairy quota holder. In 2017, unprocessed milk accounted for 10.5% of Canada’s farm cash receipts. Between 2018-2022, 7 of the 10 provinces listed dairy as one of their top three ag. commodities in farm cash receipts. Without supply management, most family dairy farms would cease to exist, as they would have smaller profits their supply would have to increase, and prices would be competitive. They would also be in worse shape as large dairy barns from the US would flood the Canadian market with dairy products. Bill C-282 aims to ensure this does not happen; however, the bill has many other producer groups up in arms.

Bill C-282 proposes an amendment to the Canadian Department of Foreign Affairs, Trade, and Development Act, excluding supply management from future trade negotiations. Considering commodity trade – especially in agriculture – supply management is the sole bargaining chip our trade negotiators have when dealing with our closest trading partners. The US, EU, and UK all want access to our value-added dairy markets, and they are willing to make significant concessions – such as a 75% reduction in the number of goods facing tariffs – to achieve increased market access. This comes to the benefit of much larger Canadian agriculture industries such as cattle and crop production by affording them increased access to the export markets they rely on so heavily. Regarding C-282, the concern arises that Canadian farmers may circle the wagons and shoot inward, pitting producers of different commodities against each other. This would be an undesirable outcome; however, it may be required to protect the future prosperity of our export reliant agriculture industry.

Supply Management Overview

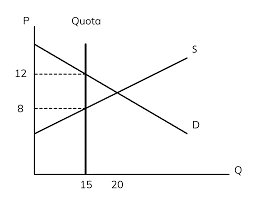

Canada’s supply management has stood in bold defiance of the principle of free trade since 1966, when dairy supply management was introduced. Working backwards from a desired price, a production quota is set to ensure supply is restricted to a level that achieves the per unit price goal. This limits the volume of fluid milk produced domestically by each operation across Canada. To ensure foreign goods are unable to enter the market, import quotas are established. These afford some nations are predetermined volume of imports before prohibitively high tariffs are applied to the goods. These tariffs ensure that no foreign goods above the import quota enter the domestic market, as the prices charged for these goods would exceed what consumers are willing to pay. This system works to protect both consumers and producers from the price volatility characteristic of commodity markets.

Many contend that the supply management hurts both producers and consumers, costing consumers over $500 per year while limiting producer opportunities to expand and the adopt new technologies. It should be noted that supply management is a regressive policy; that is, supply management hurts lower income households more than high-earning households. Low-income households are levied with a 2.29% implicit tax as result of supply management. Dissimilarly, high-income households may only 0.47%, while the average arrives at 0.82% across all households. Obviously, these results were fiercely contested in between academics who are allies and adversaries of supply management. In the end, it appears the economic rigour in the original study can be defended as robust; however, the bout of scholarly debate displays the staunch position of those with vested interests in the supply management cartel.

In fairness, Canada’s supply management policy does have some notable benefits for both consumers and producers. Commodity markets are generally cyclical, with high levels of production driving prices to below-profitable levels and driving the least efficient producers out the market. In turn, this constricts supply to a point where prices become extremely profitable – and expensive for consumers – until new entrants or expansion of existing farms restarts the cycle. Supply management protects both producers and consumers from the commodity cycle, keeping prices at a level that is acceptable for all in most instances. However, by removing the commodity cycle, incentives to innovate and improve are limited and inefficient producers may remain active – or even become the norm – to a point where even the most efficient in a supply managed industry and less efficient than those in a free market.

International Trade – A Canadian Advantage

Over 90% of Canada’s agricultural producers are highly reliant on exports to support their financial viability. This is not surprising as Canada exported $82.2 billion worth of agriculture and agri-food goods in 2021. This made us the fifth largest exporter of these products across the globe, an impressive feat for a country of less than 40 million people. Of the total value, $6 billion is beef exports, as approximately half of Canadian beef is exported. In comparison, crop export rates dwarf beef production, with values of 70% for soybeans, 75% for wheat, 90% for Canola, and 95% for pulse crops. Relative to crop and beef exports, Canadian dairy exports are merely a rounding error. In 2017, dairy exports from Canada totaled approximately $200 million, less than one-quarter of one percent of total export values.

Between 2011 and 2021, agricultural exports grew by 103%, resulting in a corresponding 46% increase in farm cash receipts. Canada’s dairy industry has been a key component of this growth, with farm cash receipts totalling $8.2 billion in 2022. Exports are critical to the financial prosperity and growth of primary agricultural production; however, beyond commodity trade, Canada’s wealth of agricultural resources affords it value-added processing opportunities. Value-added food processing represents Canada’s largest manufacturing industry, providing 250,000 jobs to Canadians in 2021. Of these positions, 25% are reliant on exports. As mentioned in an earlier blog post, the industry often has a hard time finding sufficient human capital to cover the positions in the growing industry. Canada’s agriculture and agri-food industry has capacity for further growth; however, it is trade that will facilitate this growth and provide improved economic opportunity across the nation.

C-282 – Restrictions on Future Prosperity

Bill C-282 stands in the way of future growth to Canadian agriculture and agri-food exports by tying the hands of our trade negotiators in future trade deals. In recent agreements, small dairy import concessions made by Canadian negotiators has paid dividends for the rest of the economy, allowing our exports to grow through the CPTPP agreement as well as those with the US and Mexico. In 2026, the Canada United States Mexico Agreement (CUSMA) may be renegotiated if one party to the deal does not view it as favourable in its current form. Given the United States desire for increased accession of its dairy products to Canadian markets, bill C-282 would bring any negotiations to a screeching halt. As a result, the CUSMA agreement could be scrapped, representing a major loss to all export reliant industries. While this is merely anecdotal, it displays the far-reaching implication bill C-282.

In a striking similarity to the original supply management policy, it appears C-282 is taking from the majority to provide for the few. However, unlike disaggregated groups of consumers that bear the cost of supply management with blissful ignorance, agricultural producer and commodity groups have a voice. As Bill C-282 progresses, these voices will undoubtedly lobby for the bill to be scrapped; however, there is a careful balance that must be stuck to ensure all Canadian farmers, dairy, beef, grain, oilseed, and many more, remain on the same team moving forward.

I am an not a farmer, and I also have reservations about the Supply Management dairy (and poultry) system in Canada. It has created a wealthy and nearly aristrocratic sub-class of livestock farmer. That said, I’d hate to see this Canadian agricultural sector drowned and replaced in very short orfer by American product simply to help American dairymen ‘get rid of’ their milk which is grossly over-produced daily. Open Canada’s borders completely to US fluid milk and dairy products and I doubt there would be a Canadian operator left in 5 years, probably less.

It should be noted that the US agricultural system is highly subsidized, and that includes their dairy and poultry sectors, by the huge US Farm Bill program which is completely taxpayer supported. As such, US dairy consumers have already paid for a portion of their product before they enter the grocery store. Conversely, the Canadian system is ‘largely’ self-sustaining due to its built-in profitability.

Certainly, Canada is a ‘trading nation’ which flies in the face of Supply Management, and has put our negotiators in a very tricky situation.

That said, do we want to completely depend on the US in this area? I don’t think so.

Hi Dennis,

Thank you for taking the time to provide a well thought out and thorough comment!

I appreciate your concerns and do admit they are very valid; however, I do not believe that the concerns you raised will manifest if Supply Management was abolished. Also, this post was not designed to promote the abolition of Supply Management; rather, it is designed to promote its use as a bargaining tool in international trade. This will generate a slow degradation of protections that occurs over many decades. Regardless, I will address my first point, that the U.S. entering the Canadian dairy market and overtaking Canadian dairies is unlikely to occur.

In theory, it does appear that the large US dairies are a major threat to Canadian Dairy Farmers and the sovereignty of Canadian Dairy supply. However, when analyzing the numbers it is evident that this transition could not occur rapidly, and Canadian Dairy farmers would have time to adjust to a free(r) market situation.

In November of 2023, Canadian milk production was 786 Million Kg. In the Same month, US production was 1,680 M Mg, so Canada’s production was nearly 47% that month of the US. The US would have to modify its entire supply chain from input suppliers through to transport infrastructure to produce that much more and import it to Canada as a fresh product. There would be many barriers to accomplishing this, including major land use changes from field crops or vegetable production into feed production for dairies, shortages in labour availability, and regulatory hurdles regarding the expansion of intensive livestock operations to name a few.

While it is possible that the large dairies in the US could overtake some of Canada’s market share, this would occur over a lengthy period. This would give the Canadian supply chain ample time to reorganize itself into a near-equally efficient counterpart. What this transition would look like is unknown to me; however, it would likely involve consolidation and general efficiency improvements. As a livestock producer myself, the consolidation of farms is not something I can advocate; nonetheless, I do not believe that concessions in supply management import quotas (nor the complete removal of the policy) would cost Canada its domestic independence in Dairy production.