Let’s Talk Farming

Saskatchewan farmers rely on a vast toolkit of technologies to produce their crops every year. Farming practices are always changing, and innovation and adoption of new technologies are vital to improving agricultural efficiency, productivity, and sustainability. This is the sixth in a series of blogs that will dive into some of the important technologies used by Saskatchewan farmers and discuss the current issues surrounding them. Check out the rest of the series, where I discuss fertilizer use, pesticides, seeding, digital ag, and harvest and grain storage.

What's the Scoop on Grain Marketing?

After the hard work of planting, growing, monitoring, and harvesting crops, the next step for farmers is converting their commodities into revenue. While most of the population enjoys a steady paycheck in return for their work, farmers must manage their own cash flow by selling their grain to a buyer (typically a grain elevator) who stores the grain they buy before reselling it to companies that process the grain into food products. To complicate the process, grain prices are always fluctuating in response to supply, demand, and world events. Farmers must time their grain sales to try to capitalize on the best prices but also ensure they have the cashflow to cover bill payments as they come due.

Risk Management Options

Commodity markets, similar to any other market, are largely determined by global supply and demand. Because there are so many farmers selling identical commodities, farmers are considered price takers, which means they have no way of influencing grain prices. The only exception is dairy, egg, and poultry farmers that produce products under supply management systems and do set the price of their products. Instead, all other grain and livestock farmers must focus on capitalizing when commodity prices are favourable. However, waiting for prices to climb poses some risk to farmers, as prices could also fall.

One common method of choosing what price point to sell at is calculating the break-even point, which describes the price point at which income would be equal to the costs required to produce the commodity (e.g. $/ac = cost/ac). The break-even point represents the minimum price you would sell at to avoid losing money and can be used to set a target price that will result in positive profit. There are numerous risk management strategies available to farmers to help them ensure they sell for at least their break-even price-point.

Forward Contracting

Forward contracting allows farmers to lock in a price and commit to delivery sometime in the future. This strategy is commonly used for grain that has not been harvested yet. For example, in July, a grain elevator may offer a price for November delivery. A farmer can choose to contract a portion of their production at this price, committing to delivery of this physical product at this time. This strategy helps farmers to regulate their cash flow throughout the year and mitigate risk of a price drop come fall. However, forward contracting carries its own risks. Because farmers commit to delivering the contracted amount of grain, in the case of crop failure, they must still be able to deliver the grain or buy out the contract unless the contract includes an “Act of God” clause. The inclusion of this clause in a grain contract relieves farmers of delivery obligation in the case where uncontrollable factors, such as drought, hail, or wildlife damage, lead to the crop failure.

Targets

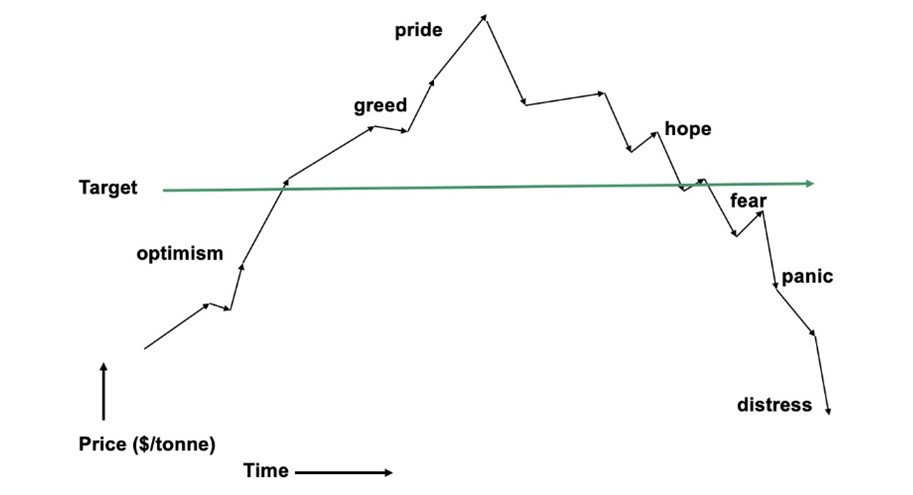

Another strategy farmers can use to capitalize on favourable prices is setting price targets at the elevator. This method differs from forward contracting in that farmers choose a price point they would like to sell at and how much grain they would like to sell at that price, and then wait for their target to trigger. For example, a farmer might choose to set a target price just above their break-even. When grain prices hit this price-point, their target will “trigger”, or lock in, without farmers having to be constantly monitoring the market price fluctuations.

When setting targets, it is important to keep track of where you have price and grain quantity targets set because, when targets trigger, you are bound to sell the agreed upon quantity of grain at that price point. If a farmer were to forget about a target they put in at one elevator previously and put in a new target at a different elevator, and they both trigger, a farmer would be bound to fulfill contracts at both elevators.

Insurance

An essential component of risk-management when it comes to grain marketing is carrying some kind of insurance. Provincially, the Saskatchewan Crop Insurance Corporation provides production insurance for farmers when uncontrollable events lead to reduced yields. Farmers choose their coverage levels and individual premiums are determined by a farmer’s historical production levels, claim history, and farming experience. Agri-Stability is another insurance program available for farmers. Rather than insuring crop production specifically, Agri-Stability provides insurance on a farm’s profit margin. Under this program, if a farm’s margin drops 30% below a reference margin determined by individual historical performance, payments are triggered. One downside to this program is that the profit margin calculation cannot be performed until the farm’s taxes are completed for the year, typically the spring following production, delaying the payment for close to a year.

Other Risk Management Options

There are many other strategies farmers might use to mitigate their marketing risk. Some crops, such as canola and wheat, have futures markets available. These markets allow farmers to protect their prices without committing to physical delivery of the grain by hedging their production. They do this by taking equal and offsetting positions (buy vs. sell) in the cash market, the market for physical delivery of the grain, and the futures market, the “paper” market where futures contracts are bought and sold. The concept of hedging grain for price protection is complex and beyond the scope of this blog. If you are interested in reading more about this marketing strategy, you can find more information here.

Another option available for some crops, especially smaller acreage crops like mustard or camelina, is contracted production. Under this type of production agreement, the farmer is paid to grow a crop, effectively providing a service, but never actually owns the commodity. The benefit of this type of contractual arrangement for farmers is price certainty and stability, as some of the risk typically carried by the farmer is transferred to the buyer. Buyers also like these contracts because they are allowed some input in production decisions.

Various other types of grain contracts exist, including minimum-price contracts, basis contracts, and futures only contracts. Each contract type provides a unique set of opportunities but also carries their own set of risks. It is up to the individual farmer to determine what type of contract suits their risk preference and marketing strategy best.

The Bottom Line

Marketing grain is much like gambling. Aggressive marketing strategies typically carry more risk, but sometimes result in higher payouts. On the other hand, more conservative strategies usually result in more consistent cash flow. How risk-averse or risk-loving a farmer is will impact how they choose to market their grain. Although we have only briefly touched on a handful of marketing strategies available to farmers in this blog, the bottom line is that farming is a business, and all farmers are trying to capture the greatest profits possible for their production. Volatile markets, unpredictable weather, and other circumstances beyond farmers’ control make farming a risky business, but there are risk-mitigation tools available to help farmers protect their income, allowing them to continue to provide safe, high-quality food for the world to enjoy.